An ultra-rare convertible, with an odometer practically “zeroed out,” a perfect scenario (F1 in Abu Dhabi), and yet… a historic hammer drop. The Bentley Bacalar case has become a warning for those who believe that “limited edition” is automatically synonymous with profit. US Auto Market Insight.

The Auction That Surprised Collectors in Abu Dhabi

During a weekend when Abu Dhabi becomes a global luxury showcase because of Formula 1, auctions often seem like a “free zone” for absurd figures. It’s the kind of environment where high-liquidity collectors impulsively buy cars motivated by exclusivity, status, and opportunity. Luxury Car Auction Analysis.

It was exactly in this context that a 2021 Bentley Bacalar (one of only 12 produced) appeared with a detail that usually drives the market crazy: very low mileage, just over 1,100 km driven. In any informal manual of automotive collecting, this should push the value higher. But the opposite happened.

The hammer fell at around US$ 876,000 (publicly reported at the event), well below what is expected for a car that was born as a coachbuilding project valued at around US$ 2 million. In practice, the Bacalar “lost” more than US$ 1.1 million with almost no use. For a car of this caliber, it’s not normal depreciation: it’s a shift in market mood. Bentley Bacalar Resale Value.

This type of drop usually generates two narratives: an emotional one (“nobody wants it anymore”) and a technical one (“nobody wants it at this price”). The truth, as always, is somewhere in the middle: The Bacalar may be desired, but it’s not being priced as an infallible asset.

What Makes the Bentley Bacalar So Special (And Why That Was Not Enough)

The Bacalar is a showcase of what Bentley can do when it decides to step out of mass production and enter the realm of extreme craftsmanship. It was developed by the Mulliner division, famous for deep customization and reviving the British tradition of bespoke coachwork. Bentley Mulliner Coachbuilding.

- Ultra-limited production: only 12 units worldwide, a number that typically creates real scarcity.

- Exclusive proposal: a luxury roadster, designed to be a “collector’s item,” not just a driveable car.

- Exceptional finish: materials, colors, and interior combinations that go beyond the standard catalog.

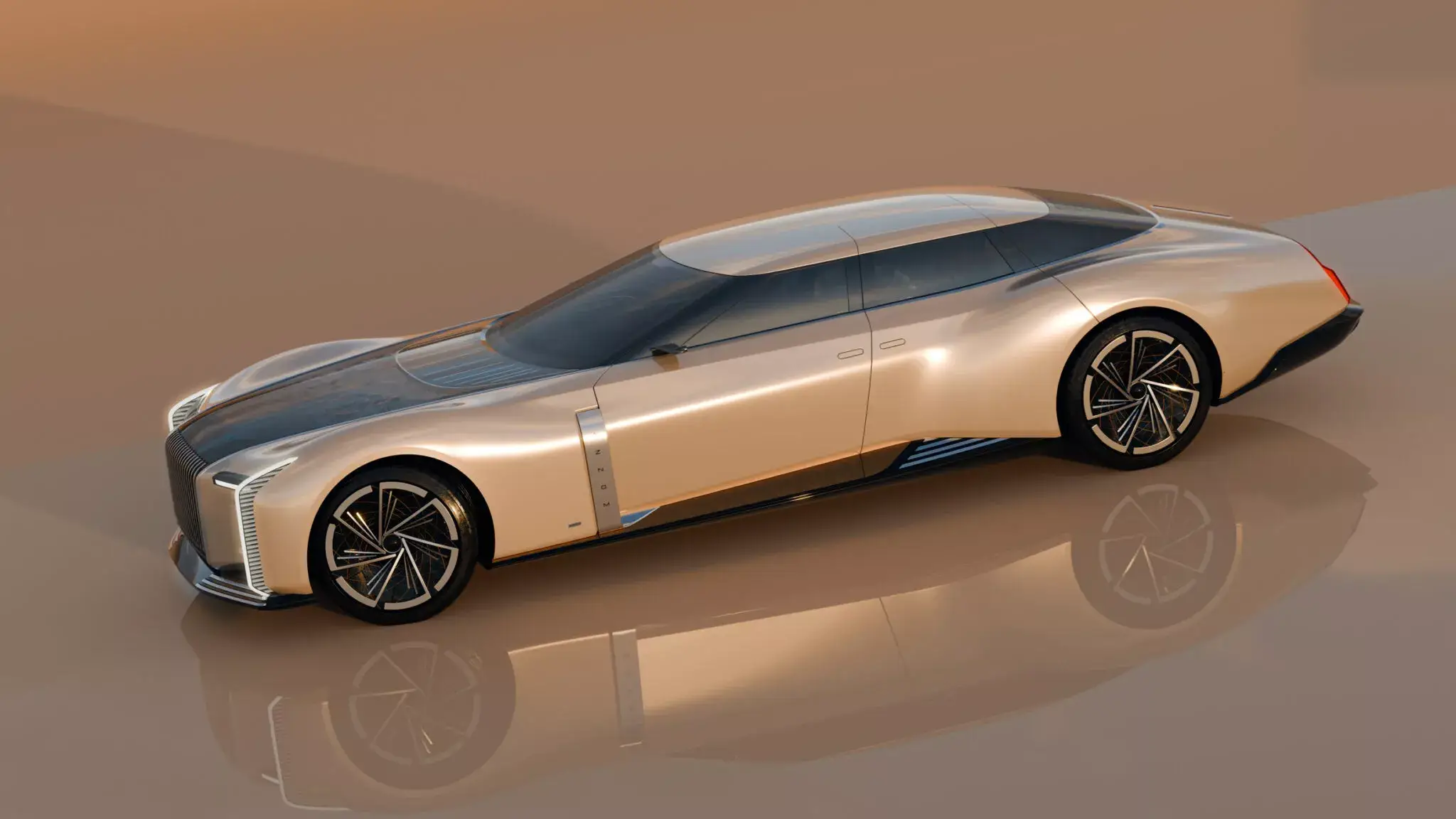

The auctioned unit drew attention with a striking visual set: deep red bodywork, large wheels with sophisticated finishes, and a cabin with light leather contrasting with dark details. Aesthetically, it’s the type of car that dominates any six-star hotel parking lot. US Luxury Lifestyle.

But then, why didn’t a car with such aura hold its value?

Because, in the collectibles market, rarity is just one pillar. And sometimes, it’s not even the most important one. Other elements weigh more:

- Clear differentiation from the regular model: the collector wants something that doesn’t seem derivative.

- Sustained global desire: hype needs to last longer than the launch.

- Liquidity: how many people worldwide would buy this car tomorrow, at this price, without hesitation?

When a model is seen as “too close” to a standard production car, it risks becoming a niche product within the niche. Then the price stops being “what it cost” and becomes “what the next top buyer is willing to pay.”

By the way, if you enjoy stories where luxury “goes upside down,” check out this content that plays with the idea of exclusivity: the Rolls-Royce Phantom with Rolex wheels that rewrites the rules of luxury.

Rarity Is Not a Guarantee: What This Case Reveals About the Luxury Car Market

There’s a persistent myth: “Limited production cars always appreciate.” They might, but it depends on a rare combination of factors. When it doesn’t fit, what the Bacalar showed live is that the market punishes entry price, not car quality. Collectible Car Investment Advice.

To understand, think about the typical behavior of models that skyrocket in value post-sale: special Ferraris, Porsche GTs with racing history, Lamborghinis with strong narratives and global demand. Usually, they share three things:

- Unmistakable identity: no confusion with the “normal” version.

- Legendary history or performance: numbers, competition, records, legacy.

- Large community of buyers: more people competing than cars available.

The Bacalar heavily invests in artisanal luxury and exclusivity but not necessarily in “legendary performance” or a global cult. It’s a car that appeals to a specific profile: collectors of design, interior, finish, and bodywork signature. But this audience is smaller and more selective, and the selectiveness increases when the perceived difference from a “conventional Bentley convertible” doesn’t seem proportional to the price jump.

Speaking of perceived difference, the world of automotive luxury is experiencing a phase where tuning companies and parallel projects are stealing the spotlight from traditional manufacturers. A recent example that sparked debate precisely because it touches Bentley’s aura is this: BRABUS 900 Superblack: the coupe that “erased” Bentley’s history. When desire shifts to “more aggressive” or “more daring,” classic luxury pieces can suffer in resale.

The “Too Similar to the Continental” Effect and the Cruel Resale Math

One of the most discussed points by analysts and enthusiasts is the conceptual proximity of the Bacalar to a Bentley Continental convertible: the same brand signature, a luxurious grand tourer proposal, and a strong presence, but with a silhouette that, for some, doesn’t fully break the “line DNA.”

And the comparison isn’t just aesthetic; it’s financial too. While a well-configured Bentley convertible can cost a fraction of the Bacalar’s price, the Bacalar was often positioned above what the market considers a “justifiable difference” without a compelling narrative.

At auction, this math turns into a verdict:

| Factor | How It Helps Value | How It Can Detract |

|---|---|---|

| Exclusivity | Real scarcity (12 units) | Poorly sized market for the ticket |

| Design/Coachbuilding | Artisanal, “object” | Subjective: taste isn’t consensus |

| Internal comparison | Bentley brand prestige | If the “cousin” costs much less, the gap bothers |

| Market timing | F1 attracts billionaires | Even billionaires avoid bad deals |

In other words: the car may be flawless, but the market is merciless when it sees “historic overpricing” instead of “inevitable piece.” Luxury Car Valuation Factors.

What This Teaches About Buying Cars as Investments (And For Car Lovers)

The Bacalar case is a goldmine for two audiences: those seeking financial return and those passionate about the automotive universe.

For buyers thinking long-term, the lesson is straightforward: buying at the top requires a long-term thesis. In other words, it’s not enough to be rare; it has to be rare and widely desired, with future liquidity. Artisanal luxury models may take longer to “find their audience” in the secondary market. And until that happens, they can bleed value.

For car enthusiasts, there’s a fascinating side: sometimes, the market allows an extremely exclusive car to become “less unreachable” than it should be. It’s still a stratospheric value, of course, but the logic changes: what was “only for a few” becomes “for very few with opportunity.”

There’s also an important background: the high-end consumer’s desire has oscillated between tradition and technology, between large engines and electrification, between quiet status and eye-catching performance. And this directly influences which types of cars become “strong currency” at auction. If you want to understand how part of the public is changing their minds, this theme connects well with the moment: more buyers are abandoning electric cars and returning to gas. Automotive Market Trends.

In the end, the Bacalar didn’t turn into a “bad” car because its price fell. It became a case study about perceived value, positioning, and the line between real and perceived exclusivity.

And if you enjoy following rarities that impact the market and pop culture, there’s another auction that also draws attention for different reasons (history, celebrities, emotional appeal): you can buy Paul Walker’s 2005 Ford GT.

In simple language: the Bentley Bacalar remains one of the most exclusive convertibles of the modern era, but the Abu Dhabi auction showed that today, the market isn’t willing to pay any price just because there are 12 units. In the world of billionaires, even impulse has its spreadsheets. US High-End Collector Insight.